Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

Credit score is an important indication of one’s financial status. While frequently used by banks and creditors to assess loan applicants, it is surprisingly overlooked by consumers themselves.

Let’s try to understand the basics of a credit score and how much is a good credit score:

What is Credit Score?

In simple terms, a credit score is a number that denotes your creditworthiness. It is derived by analysing your credit history. A good credit score will help you in getting loans easily, at low interest rates.

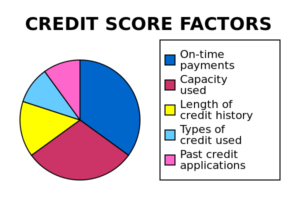

How is Credit Score Calculated?

A credit score is broadly determined on the basis of the 3 C’s of credit ー character, capacity and capital. Your past history of debts in terms of its amount, tenure, frequency and repayment pattern predicts your character in terms of handling financial obligations. Your capacity for taking a new loan is mainly determined by your income over the last couple of years, other loans being serviced and how many credit accounts you have. The capital or assets available with you like a car, real estate and other investments serve as a collateral against a loan.

Apart from the above-mentioned factors, there are many other metrics that give an insight into your financial discipline and they all influence your score.

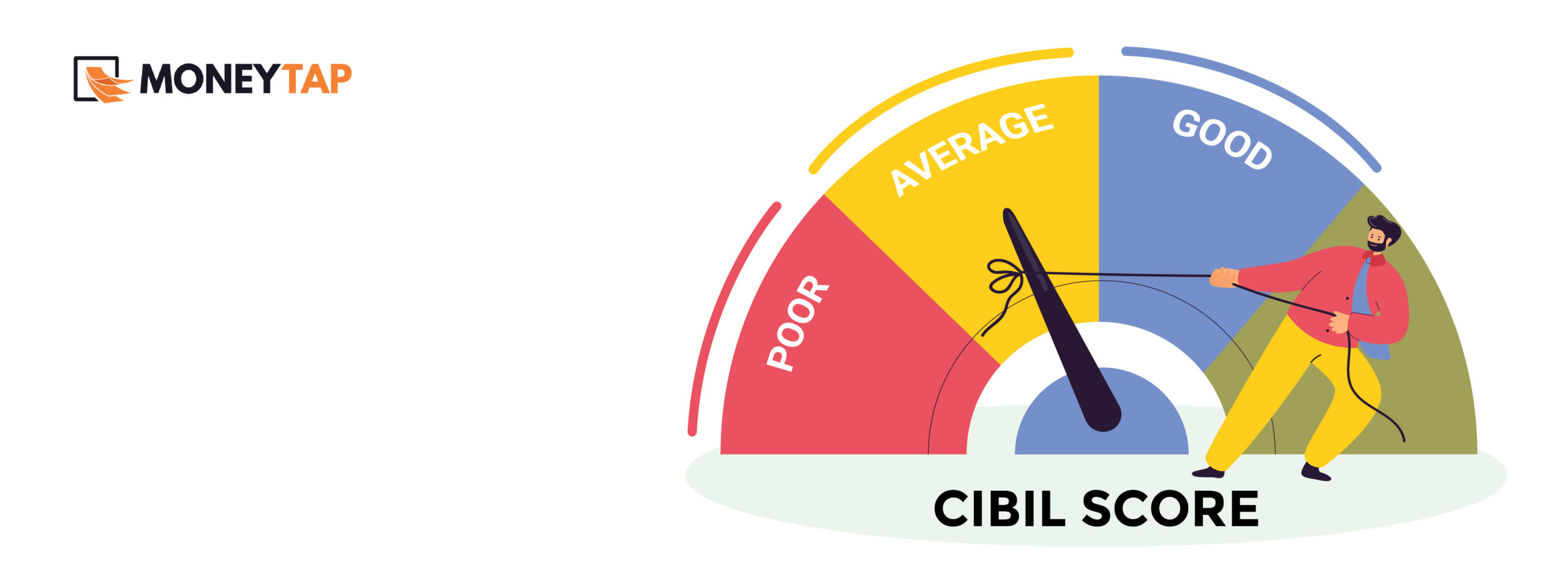

What is a Good Credit Score?

While your CIBIL score can be between 300 and 900, however, very few loans get approved for individuals with a credit score of less than 700 (Know more about CIBIL score and your loan eligibility). As per the credit bureau, 79% loans are approved are for individuals with a score greater than 750. If you do not have a credit history or have had no credit activity in the past couple of years, you may also get a rating of ‘NA’ or ‘NH’. This does not necessarily imply a bad score.

Paying your dues on time is the most obvious way of maintaining a good credit score. Be diligent and ensure you do not miss repayment dates. Some other ways that can help to improve your score are by not taking too many loans, not having more than required credit accounts and by monitoring all your accounts including the ones that you jointly hold.

What Should You do if You Have a Low Credit Score?

Always remember to find out your credit score before applying for a new loan. If you have a low credit score due to bad debts or late repayments you may have trouble getting new loans. Even if you do get the loan approved, the rate of interest will be very high. If your loan amount is huge, this can cost you a significant amount over the years.

Also, prior to applying for a loan, check your credit report and make sure there are no inaccuracies. Avoid making too many enquiries and apply for a loan with various banks since that also reflects on your credit score. There are many other ways to improve your credit score but you will need to plan months in advance before actually applying for a fresh loan. Several credit counselors are available for free or at a fee to guide you depending on your situation.

Maintaining your finances prudently is a discipline and a matter of habit. As long as you do not spend more than you earn, your credit history will be clean. Having said that, it is good for you as a consumer to know the basics of financial matters that affect you.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore